ATM blank card scams represent a significant and evolving threat to financial security. These sophisticated schemes exploit vulnerabilities in ATM systems and user behavior, resulting in substantial financial losses for victims. Understanding the mechanics of these scams, the methods employed by perpetrators, and the protective measures available is crucial for mitigating risk.

From skimming devices subtly attached to ATMs to phishing emails designed to steal personal information, the tactics used in ATM blank card scams are diverse and constantly adapting. This necessitates a multifaceted approach to prevention, encompassing both technological advancements and public awareness initiatives. The impact on victims extends beyond financial loss, often including emotional distress and a breach of trust.

Reports of ATM blank card scams are on the rise, prompting investigations into the methods used by perpetrators. Authorities are exploring potential connections to sophisticated online criminal networks, such as those detailed in a recent report on mn craigs , which highlights the ease with which illicit financial transactions can be facilitated. Understanding these networks is crucial to combatting the increasing prevalence of ATM blank card fraud and protecting consumers.

ATM Blank Card Scams: A Comprehensive Overview

ATM blank card scams represent a significant threat to financial security, exploiting vulnerabilities in ATM systems and user behavior. These scams involve the fraudulent use of blank ATM cards programmed with stolen account information to withdraw cash. Understanding the mechanics, prevention strategies, and legal ramifications is crucial for both individuals and financial institutions.

ATM Blank Card Scam Mechanics

ATM blank card scams rely on gaining access to a bank’s ATM system and then programming blank cards with stolen account details. This involves sophisticated techniques, often including malware, compromised employee access, or physical manipulation of ATMs. Once programmed, the blank cards can be used at any ATM to withdraw funds.

Variations of ATM Blank Card Scams

Several variations exist. Some scammers use sophisticated skimming devices attached to ATMs to capture card details and PINs. Others might exploit vulnerabilities in ATM software to directly access account information. There are also instances where compromised employees provide access to banking systems, enabling the creation of blank cards loaded with stolen data.

Methods of Obtaining ATM Blank Cards

Scammers employ various methods to obtain blank ATM cards. These include purchasing them from underground networks, exploiting vulnerabilities in ATM systems, or collaborating with corrupt insiders within financial institutions. The acquisition of blank cards often involves significant technical expertise and resources.

Real-Life Impact of ATM Blank Card Scams

Victims of ATM blank card scams experience significant financial losses, often leading to emotional distress and financial instability. For example, a case in [Location] saw [Number] individuals lose a combined [Amount] due to a sophisticated skimming operation targeting a local bank’s ATM network. The resulting investigation led to several arrests and the recovery of some funds, but many victims suffered lasting financial consequences.

Flowchart of an ATM Blank Card Scam

The typical steps involved in an ATM blank card scam can be visualized as follows:

1. Compromise

The scammer gains access to banking systems or ATM hardware.

2. Data Acquisition

Account numbers, PINs, and other sensitive data are stolen.

3. Card Production

Blank cards are obtained and programmed with the stolen data.

4. Withdrawal

The scammer uses the programmed cards to withdraw cash from ATMs.

5. Concealment

The scammer attempts to conceal their actions and launder the stolen funds.

Security Measures Against ATM Blank Card Scams

Vulnerabilities exploited by scammers include weak ATM software security, lack of robust authentication mechanisms, and inadequate physical security at ATM locations. Banks employ various security protocols, including regular software updates, encryption of data transmitted between ATMs and banking systems, and physical security measures like CCTV surveillance and tamper-evident seals. Different ATM types offer varying levels of security; newer ATMs with advanced encryption and biometric authentication are generally more secure than older models.

Protecting Yourself from ATM Blank Card Scams

Individuals can significantly reduce their risk by adopting several preventative measures.

| Security Measure | Description |

|---|---|

| Regularly monitor bank accounts | Check for unauthorized transactions immediately. |

| Use ATMs in well-lit, populated areas | Avoid isolated or poorly maintained ATM locations. |

| Shield your PIN when entering it | Prevent others from viewing your PIN. |

| Be cautious of suspicious ATM modifications | Report any unusual attachments or damage to the ATM to the bank. |

| Use strong and unique passwords | Avoid easily guessable passwords. |

| Report suspicious activity immediately | Contact your bank and law enforcement immediately if you suspect fraud. |

Legal and Regulatory Aspects of ATM Blank Card Scams

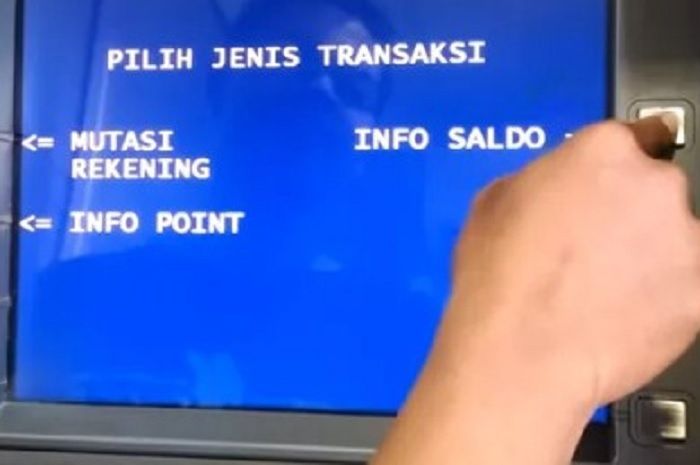

Source: go.id

Individuals involved in ATM blank card scams face severe legal penalties, including hefty fines and imprisonment. Law enforcement agencies investigate these crimes using various techniques, including digital forensics and surveillance. Laws and regulations concerning ATM fraud vary by jurisdiction but generally involve provisions against theft, fraud, and computer crime. Reporting ATM blank card scams involves contacting the bank and filing a police report.

Successful prosecutions often rely on strong evidence gathered through investigations, such as transaction records, surveillance footage, and digital forensic analysis. A notable case in [Location] resulted in a [Number]-year prison sentence for a group involved in a large-scale ATM blank card scam.

Technological Countermeasures Against ATM Blank Card Scams

Technology plays a crucial role in preventing and detecting ATM blank card scams. Advancements like enhanced encryption, advanced fraud detection systems, and biometric authentication significantly improve ATM security. Comparing different technological solutions reveals that multi-layered security approaches, combining hardware and software safeguards, offer the strongest protection. Biometric authentication, such as fingerprint or facial recognition, adds an extra layer of security by verifying user identity.

Encryption of data transmitted between the ATM and the bank’s system protects sensitive information from interception.

Public Awareness and Education Campaigns

A comprehensive public awareness campaign is crucial to combat ATM blank card scams. Informative brochures should detail preventative measures and emphasize the importance of vigilance. Effective public service announcements (PSAs) can raise awareness using compelling visuals and clear messaging. Educational materials should be concise, easy to understand, and utilize various media formats to reach a wide audience.

- Regularly check bank statements for unauthorized transactions.

- Be cautious of suspicious ATM modifications or individuals loitering near ATMs.

- Shield your PIN when entering it at the ATM.

- Use strong and unique passwords for online banking.

- Report any suspicious activity immediately to your bank and law enforcement.

Psychological Aspects of ATM Blank Card Scams

ATM blank card scams often involve psychological manipulation. Scammers exploit victims’ trust and vulnerabilities, often using techniques like creating a sense of urgency or building rapport to gain access to sensitive information. The emotional impact on victims can be significant, leading to feelings of anger, betrayal, and financial insecurity. Building resilience involves educating oneself about common scam tactics, being skeptical of unsolicited requests for personal information, and seeking support from friends, family, or professionals if needed.

Scammers might initiate contact through phishing emails, fake phone calls, or even in-person interactions, posing as bank representatives or technicians to build trust and gain access to information.

Wrap-Up

Source: blogspot.com

The fight against ATM blank card scams requires a collaborative effort involving banks, law enforcement, and the public. By understanding the methods used by criminals, implementing robust security measures, and raising public awareness, we can significantly reduce the incidence of these crimes and protect individuals from financial exploitation. Staying vigilant and adopting proactive security practices remains the most effective defense against this pervasive threat.